Listed buildings insurance

Contents |

[edit] Introduction

England has nearly 500,000 listed buildings and their owners must protect them for the benefit of current and future generations. Ensuring a listed building is insured against accident or other damage is as important, if not more so, than that for a non-listed building.

Insurance is critical as damage to the property may need to be repaired by skilled craftsmen using specialist materials and techniques – which can be costly. This in turn can mean that insurance premiums may be higher than for standard properties. In addition, the likelihood of unforeseen problems can be greater for a listed building than a standard one.

Standard building insurance for domestic, commercial and public property is unlikely to offer the degree of protection that a specialist listed building policy can offer.

Just like a standard homes policy, a listed building can be insured for both ‘buildings’ and ‘contents’.

[edit] Buildings

The building is normally covered for costs that result from fire, subsidence, theft, flood, burst pipes and accidental damage. Fire continues to be the biggest risk to listed buildings, but recent years have seen greater threats from storms, extreme rainfall and flooding which may demand more adaptation, protection and insurance.

If damage occurs, planning legislation may require ‘like-for-like’ reinstatement which can require a more comprehensive and therefore costly level of insurance cover compared to properties of modern construction. Properties that are licensed for public use may attract additional statutory duties, such as public and employer’s liability insurance

Unique risks which typically apply to listed buildings include things like thatched roof fire. If the policy does not extend to cover outbuildings, gardens and patios, a separate policy may be possible with a different insurance provider. Other risks that may require special consideration include heave and subsidence (sometimes not included in standard policies), and unoccupied insurance which covers properties left unoccupied for extended periods – usually longer than a month.

[edit] Contents

Contents cover can include the cost of repairs or replacement for items such as furniture, paintings, ceramics and clothing. Other extras may extend cover to include personal belongings (such as jewellery and mobile phones).

[edit] Listed for a reason

A listed building is listed for a reason. When considering the type of insurance to choose therefore, it is important to understand the building’s most important features, whether from an architectural or historic point of view. This will enable a proper and realistic valuation to be given which, in turn, will determine the correct premium.

Owners and their agents should be aware that they may face legal action if they knowingly under-insure a listed building (declaring the value of the building or its contents to the insurer to be lower than it is so as to pay a lower premium.)

Historic England’s key issues to consider when insuring historic buildings are set out below:

What is the extent of insurance cover needed?

- What needs insuring?

- Are there ancillary structures or special contents that should be included?

- Are the services of an insurance broker required to look at different options?

What type of cover is needed?

- What type of policy would be best suited to the insurance cover required?

- What conditions and exclusions does the policy cover?

- What insured risks does the policy cover?

- Does the fact of public access require public liability insurance?

- Does a property involving staff or volunteers require employer’s liability insurance?

Assessing the reinstatement cost

- Does the ‘declared sum’ in the policy reflect the reinstatement cost assessment?

- Is professional help required to assess reinstatement costs?

- Have reinstatement costs been updated every year?

Reducing the risks

- Maintenance and repair – continuous care will help to avoid major repairs and potential claims.

- Fire – establish the risks and how these might be mitigated.

- Flooding – establish the level of risk and what measures could be put in place to reduce potential damage.

- Security – establish the risks and put measures in place.

- Building works – consider the risks posed during building works.

- Emergency planning – larger complex buildings and estates should have a plan in place.

[edit] Related articles on Designing Buildings Wiki

- Are works to listed buildings demolition or alteration?

- Building Preservation Notice.

- Cautions or formal warnings in relation to potential listed building offences in England and Wales.

- Certificate of immunity.

- Certificate of Lawfulness of Proposed Works.

- Conservation area.

- Conservation officer.

- 'England's Post-War Listed Buildings'.

- Forced entry to listed buildings.

- Heritage at Risk Register.

- Historic England.

- Listed Building Consent Order.

- Listed buildings

- Planning authority duty to provide specialist conservation advice.

- Scheduled monuments.

- The history of listed buildings.

- What approvals are needed before construction begins.

[edit] External references

- Historic England: Insuring Historic Buildings and other Heritage Assets [download]

IHBC NewsBlog

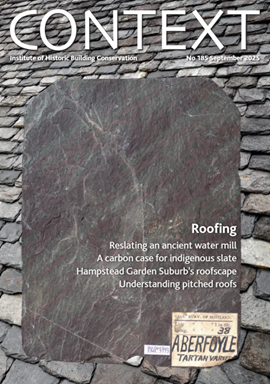

Latest IHBC Issue of Context features Roofing

Articles range from slate to pitched roofs, and carbon impact to solar generation to roofscapes.

Three reasons not to demolish Edinburgh’s Argyle House

Should 'Edinburgh's ugliest building' be saved?

IHBC’s 2025 Parliamentary Briefing...from Crafts in Crisis to Rubbish Retrofit

IHBC launches research-led ‘5 Commitments to Help Heritage Skills in Conservation’

How RDSAP 10.2 impacts EPC assessments in traditional buildings

Energy performance certificates (EPCs) tell us how energy efficient our buildings are, but the way these certificates are generated has changed.

700-year-old church tower suspended 45ft

The London church is part of a 'never seen before feat of engineering'.

The historic Old War Office (OWO) has undergone a remarkable transformation

The Grade II* listed neo-Baroque landmark in central London is an example of adaptive reuse in architecture, where heritage meets modern sophistication.

West Midlands Heritage Careers Fair 2025

Join the West Midlands Historic Buildings Trust on 13 October 2025, from 10.00am.

Former carpark and shopping centre to be transformed into new homes

Transformation to be a UK first.

Canada is losing its churches…

Can communities afford to let that happen?

131 derelict buildings recorded in Dublin city

It has increased 80% in the past four years.